-

WorldFish partnered with Bank Asia to increase the financial literacy among aquatic food producers in Northern Bangladesh.

-

This partnership also saw aquatic food producers obtaining easier access to financing through a decentralized system developed by Bank Asia.

Al-Amin is a successful aquatic food producer from Rajshahi who produces fingerlings – juvenile fish for stocking in production systems – in his three ponds on 10 acres of land. His intention to expand his business in 2017 was not fruitful as he didn’t have the financial means and wasn’t able to secure a loan to do so. Many aquatic food producers in Rajshahi and Rangpur encounter similar difficulties in obtaining loans to expand their businesses.

A research conducted by the Bangladesh Fish and Shrimp Foundation in 2017 found that 77.3 percent of aquatic food producers in Bangladesh were unable to obtain financial support from traditional banks due to the lack of collateral. As a result, small-scale aquatic food producers had to rely on informal financing sources despite unfavorable terms such as higher interest rates and hidden charges.

To address this issue, WorldFish collaborated with Bank Asia to provide low-interest and collateral-free loans to small-scale aquatic food producers. As part of this collaboration, WorldFish also aims to provide financial literacy training to 25,000 small-scale aquatic food producers that will better equip them for the future.

Bank Asia is the first formal banking institution to provide collateral-free loans with favorable interest rates for aquatic food producers and suppliers. It also has a wide presence in rural areas and experience working through banking agents and micro-merchants to reach producers most in need of loans.

They had realized that the aquatic foods sector is a hitherto untapped market with a high demand for loans. Bank Asia has since extended credit services to aquatic food producers in the northern and southern regions of Bangladesh with plans to expand to the rest of Bangladesh with the support of WorldFish.

Training aquatic food producers to be more financially literate

Along with 25 other aquatic food producers, Al-Amin received financial literacy and banking services training from the Sutihat agent outlet in Rajshahi. The training was made possible by an aquatic feeds supplier who has since become a micro-merchant by Bank Asia.

The training was the first time that some of the farmers discovered the various banking services available to them. Upon learning of the loan facility for small-scale aquatic food producers and its favorable terms – collateral-free and 9 percent interest loan calculated on reducing balance – compared to credit facilities offered by other banks, financial institutions, NGOs and informal loan services in their respective regions, some of them took the opportunity to apply for a loan, which was approved and disbursed within a month.

During the COVID-19 pandemic, the Bangladesh government stepped in to partially underwrite the loans effectively lowering the interest rate to just 4 percent. In November 2021, Bank Asia revised the interest rate downwards by 1 percent.

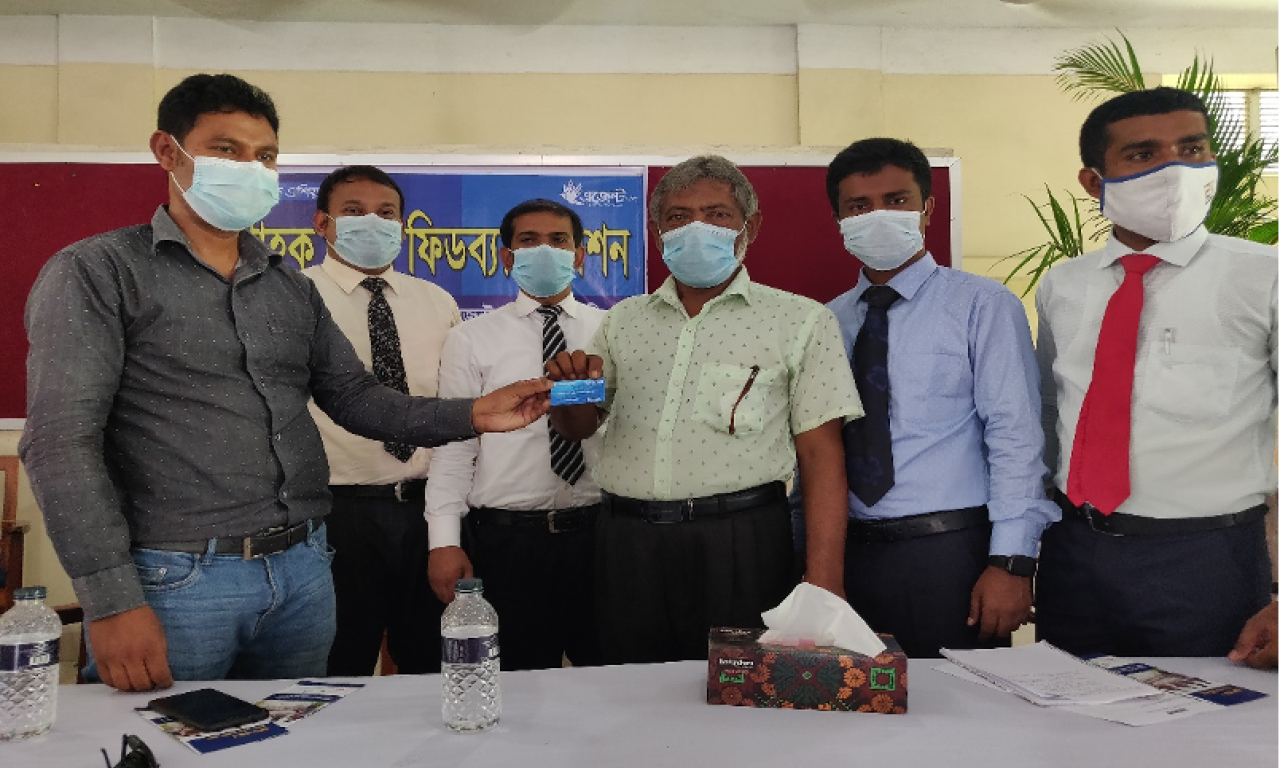

The loans were disbursed through a Fish Card, a type of credit card with a credit limit equal to the loan amount approved for the borrower. Aquatic food producers will be able to withdraw money through agent outlets or micro-merchants with the Fish Card. They will also enjoy discounts if they purchase supplies with the Fish Card from designated partners determined by Bank Asia.

Ironing out niggling issues

The simple loan application process, which only requires the submission of their National Identity Cards and a recent passport photo of themselves and their nominees, has resulted in approximately 600 loans valued at over $270,000 (BDT 25 million) to be disbursed to small-scale aquatic food producers up till September 2021. Some of the farmers from Rajshahi and Rangpur have already repaid the initial loans and have since applied for a new loan to prepare their ponds for the coming production cycle.

The huge demand for loans from aquatic food producers has created a backlog for agent outlets in processing new applications. On top of that, several aquatic food producers in Rangpur experienced delays in obtaining their loans. The delay could be attributed to the poor performance of a specific agent outlet in recovering loans resulting in Bank Asia delaying the disbursement of new loans.

Despite the relative success, many aquatic food producers still do not know of this credit facility offered by Bank Asia. Efforts to effectively inform a wider audience must be ramped up so more aquatic food producers can benefit from this facility.

Aquatic food producers have been advised to start the application process sooner ahead of the production cycle so that any untoward delays will not thwart their plans. They have also been advised to apply for a higher loan amount with inflation expected to increase overall production cost and develop a monitoring system to ensure the loans are used effectively.

WorldFish is working with Bank Asia to iron out these niggling issues to ensure financing is available for aquatic food producers when they need it.