Integrated Multi-Trophic Aquaculture (IMTA) is increasingly recognised as an approach that can strengthen the sustainability of aquaculture systems. By combining species from different trophic levels, such as fish, shellfish and seaweed, IMTA makes better use of resources, reduces waste and supports more resilient production systems.

In coastal Bangladesh, for example, farmers have demonstrated improved profitability, diversified income streams, and more resilient production through IMTA practices. These experiences show that the technical case for IMTA is strong.

Awareness is no longer the problem. Across Africa and Asia, aquaculture is firmly on the agenda as a source of food, livelihoods, and climate resilience. What’s still missing is a practical way for farmers and investors to decide whether IMTA makes sense in their context, before they commit.

The Decision Gap

For farmers, adopting IMTA often means changing familiar systems, introducing new species, and taking on additional costs with uncertain returns. For investors, including absentee producers and capital holders who are not directly involved in day-to-day farming, IMTA systems can look complex and difficult to assess, especially when outcomes vary by site, species mix, and management approach.

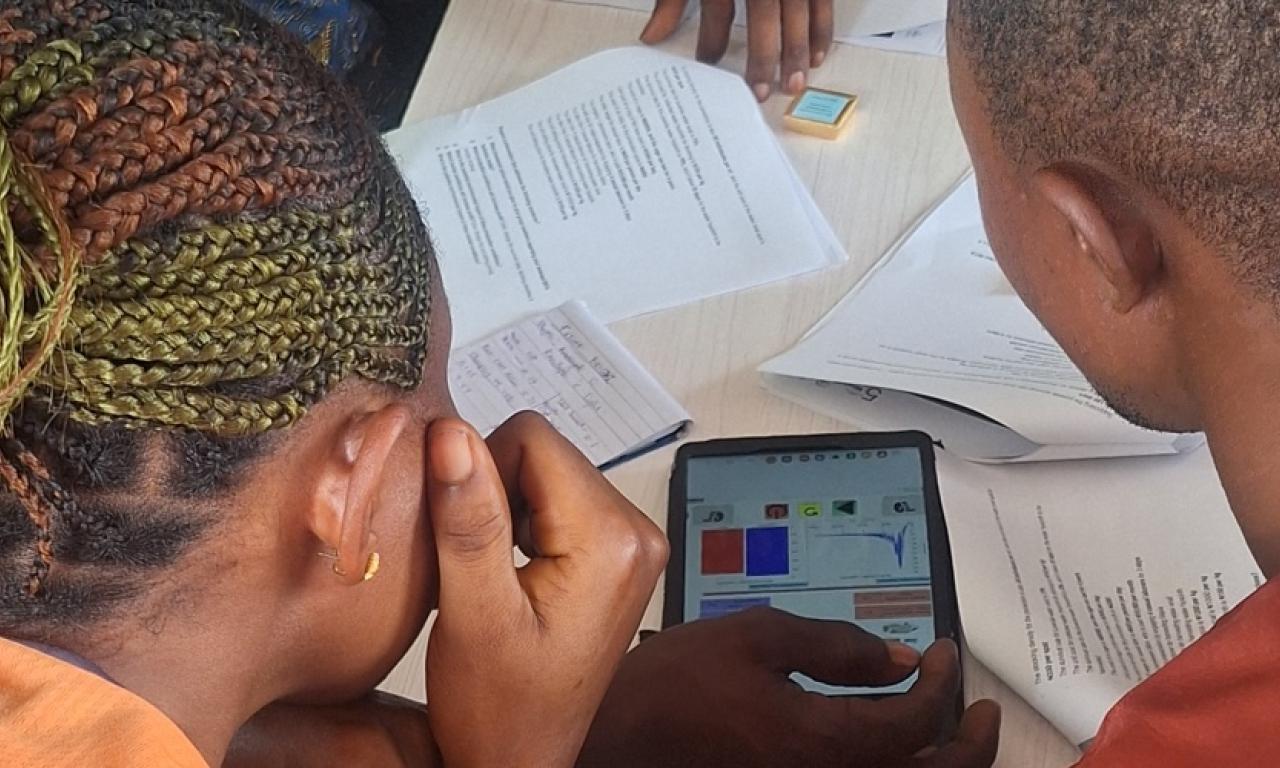

Training and demonstration farms play an important role in building technical skills and confidence. In Kenya, hands-on IMTA pilots and Farmer Field School activities are helping farmers learn how to manage integrated systems, collect data, and interpret changes in water quality and growth.

Understanding how IMTA works doesn't automatically answer whether it makes financial sense in a particular context.

Making Trade-Offs Visible

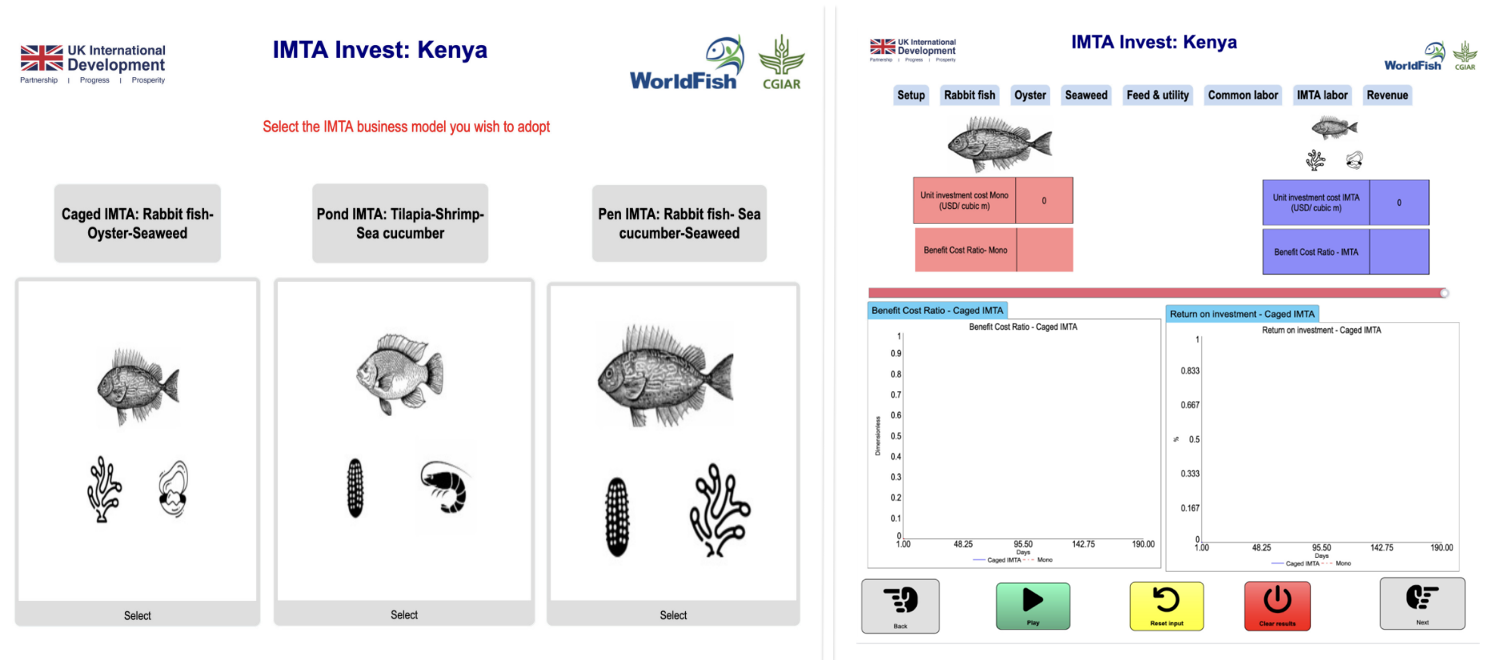

To address this gap, WorldFish, through the Asia–Africa BlueTech Superhighway (AABS) project, has developed IMTA INVEST, a decision-support tool designed to make the risks and returns of IMTA more visible before farmers and investors commit their resources.

IMTA INVEST is designed for decision moments. When a farmer is considering whether to shift away from monoculture, to add new species, or expand production, the tool allows them to explore different scenarios using just their mobile phone. By entering basic information about their current system and adjusting variables such as species combinations, scale, costs, and prices, IMTA INVEST users can compare options side by side and see how different choices affect profitability and environmental performance.

Rather than producing a single recommendation, the tool helps users understand trade-offs. It supports discussion and decision-making, rather than replacing experience or advice.

Why Costs Matter, Especially Feed

One reason investment decisions in aquaculture are difficult is that the biggest costs are often the hardest to anticipate. Feed, in particular, is usually the single largest expense, accounting for more than half of production costs in many systems.

In IMTA systems, that uncertainty doesn’t disappear. Feeding decisions still carry financial risk, but they now interact with a more complex system involving multiple species and management choices. This makes it harder to judge, on paper, how costs and returns might play out before a system is operating. IMTA INVEST is designed to make these trade-offs clearer.

Try IMTA INVEST Now

IMTA INVEST is now live in its first generation and continues to be tested and refined. Early versions of the tool have been pretested with selected producer associations in Kenya, alongside IMTA pilot sites and Farmer Field School activities. The Kenya version is publicly available here – IMTA INVEST Kenya

In Nigeria, a country-specific version of IMTA INVEST has also been developed and introduced alongside recent IMTA training. While the interface remains consistent, the underlying investment models reflect local production systems and species combinations, ensuring the tool is relevant to farmers’ local contexts. The Nigeria version can be accessed here – IMTA INVEST Nigeria

Across both countries, testing is closely linked to hands-on learning. Farmers are already managing integrated systems, collecting their own data, and tracking changes through regular sampling and monitoring. IMTA INVEST builds on this by helping them step back and ask what those numbers could mean for future investment decisions.

Feedback from farmers is already shaping the next iteration, from simplifying the interface to improving how scenarios are presented and interpreted in real-world contexts.

From Ambition to Informed Choice

The case for investing in aquaculture is already well made. What matters now is how that ambition translates into decisions on the ground, where conditions vary, risks are real, and mistakes can be costly.

As IMTA INVEST evolves, lessons from Kenya and Nigeria will shape how the tool is refined and used. The aim is to give farmers and investors a clear basis for deciding whether IMTA makes financial sense for them, before making the jump.

Cover photo: Aquaculture stakeholders in Nigeria test the IMTA INVEST tool during a hands-on training session, exploring how different species combinations and costs affect investment outcomes. Photo: Joshua Aboah/WorldFish.